- Compare bank and private lender options

- Internal underwriting to quickly size MF loans

- Navigate different terms between lenders

For multifamily loans, our private lenders are competitive on leverage, seasoning, DSCR requirements, albeit at a higher interest rate than full doc bank loans. We work with banks that are competitive on interest rate. Compare bank and DSCR multifamily loans with Nonbank Clearing!

What is a Multifamily Loan?

A multifamily loan is a loan for a property that has 5 or more residential units, and no commercial property use (such as a retail store downstairs). These are loans for apartment buildings, and at banks they are often in the same category as commercial real estate loans. For multifamily DSCR loans (multifamily private term loans), the rates are higher than 1-4 unit DSCR loans but lower than commercial DSCR loans. Investors seek use multifamily DSCR loans to avoid going thru a full doc loan process, or if they want more flexibility on seasoning or DSCR requirement. There are also life insurance companies, Fannie Mae, and other lenders available for multifamily owners and investors.

How to Qualify for a Multifamily Loan?

Call 609-468-9324 or email [email protected] and we can provide information on available programs and parameters. Same day preapproval, and 1-2 day approval for no doc multifamily loans. Longer timeline for bank loan approval. Hope to earn your business!

Multifamily Bank Term Loan Calculator

Bank loans for multifamily and commercial property are full doc loans, meaning they require 2 years personal and business income history, and the bank will verify assets (e.g. cash, stock, retirement plans, and other real estate owned). Unlike DSCR loans, banks typically do not escrow for property taxes and property insurance, so the monthly payment is just Principal and Interest (PI), as opposed to a DSCR loan payment which is Principal, Interest, Taxes, and Insurance (PITI). Typical amortization terms for bank loans are 20 years (240 months) and 25 years (300 months).

Up Front Costs

Bank loans have more stringent DSCR requirements than DSCR lenders.

Multifamily DSCR Loan Calculator

Almost all DSCR loans are 30 year term, so we’ve plugged in 360 months for the term length.

For 1-4 unit residential, multifamily, and commercial / mixed use DSCR loans, the lenders escrow the estimated monthly cost for property taxes and property insurance. The monthly payments are PITI (Principal + Interest + Taxes + Insurance), like a 30 year home loan, even though these are commercial loan products.

Up Front Costs

In choosing a DSCR lender, rates, points, and fees are important, but equally important are service, reliability, and not finding a lender that bids low to win loans and re-trades later.

DSCR lenders have less stringent dscr criteria than bank lenders. DSCR loans for 1-4 unit residential properties do not require leases or occupancy, and lenders can go off market rate for rents. DSCR loans for multifamily, mixed use, and commercial, typically require 70% occupancy. The usual dscr requirement for a DSCR loan is 1.00, based on rents divided by the PITI monthly payment with 30 year amortization, and we have lenders that can work with 0.75-0.99 dscr for certain scenarios. A full doc bank loan would adjust rental income downward for operating expenses and vacancy (not just taxes and insurance) and require 1.20 or 1.25 dscr at 20 or 25 year amortization.

Multifamily DSCR Loan vs. Multifamily Bank Term Loan

| Multifamily DSCR Loan | Multifamily Bank Term Loan | |

|---|---|---|

| Term | 30 years | 5, 20, 25, or 30 years |

| Income and asset verification | No doc loan | Full income and asset verification required |

| Seasoning for cash out refi | 6 months | 6-24 months |

| DSCR Requirement | Varies, as low as 1.00 with 30 year amortization | Typically 1.20-1.25 with 20 or 25 year amortization |

| LTV Requirement | 65-75% cash out refi 75-80% purchase |

65-70% cash out refi 70-80% purchase |

| Time To Close | 30 days | 40-60 days |

| Rates, Points and Fees | Higher than bank loan rates | Lowest rates available |

| Payment Escrows | Monthly payments include tax and insurance escrow | Taxes and insurance paid outside monthly payments |

| Occupancy Requirement | 70% | 70% |

| Minimum FICO Score | 620-680 minimum | 620-680 minimum |

| Rehab Budget | None | None |

Multifamily DSCR loans are used by borrowers who don’t want to go thru a full doc income and asset verification process, and want the higher leverage afforded by more flexible DSCR, LTV, and seasoning requirements.

Multifamily bank term loans, and institutional programs, have the most competitive rates, and those are full doc loans that require 2 years income and asset verification, and more stringent property and borrower level underwriting.

Multifamily Loan Process

Step 1- Initial Discussion, Loan Application, and Term Sheet

- Discuss the loan scenario including rehab construction plan, costs, and end value

- Suggest relevant loan programs and provide parameters

- Scope of Work form and recent experience schedule (we can get this over the phone too)

- Loan application and initial info request (we can get this over the phone too)

- Term Sheet and Appraisal Fee (if required)

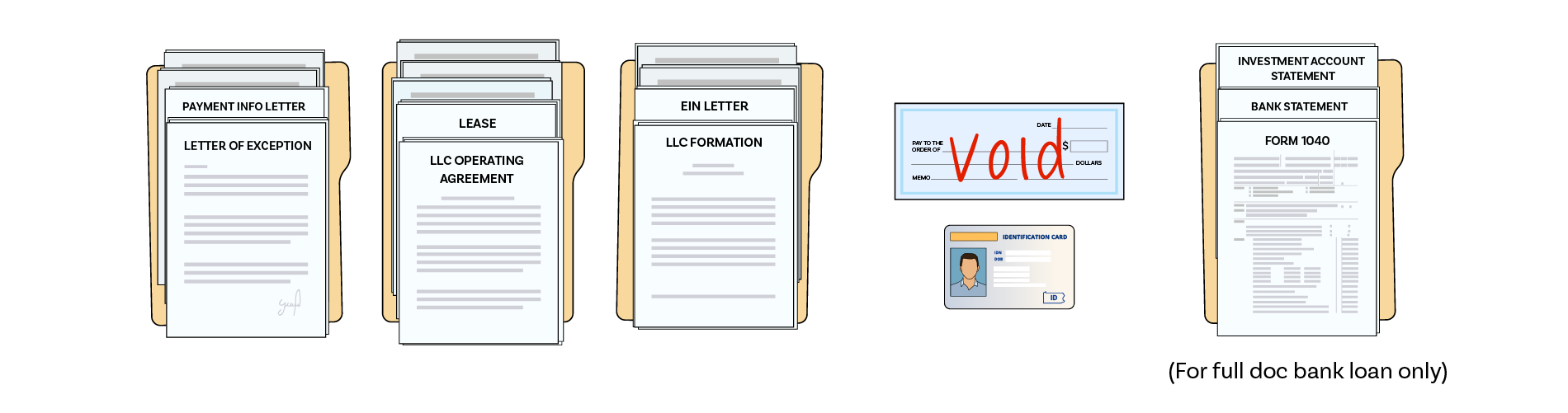

Step 2- Initial Info Required for Multifamily Loan

- Loan Application and Appraisal Fee if required (see previous step)

- Photo of ID and void check

- Contact information for your title agent and insurance agent

- If borrower is an LLC, then LLC Operating Agreement and EIN Letter

- Bank statements with cash to close and required reserves

Step 3- Appraisal, Title, Insurance, and Additional Info from Borrower

- Appraiser visits the property and completes the appraisal report or borrower submits photos for lender (for our lenders that do desktop appraisal).

- Lender reviews the appraisal report, internally re-checks value and reviews for property condition, or completes internal valuation (desktop appraisal).

- Title agent provides title policy, works with lender on revisions and clarifications

- Insurance agent provides insurance policy, works with lender on revisions and clarifications

- Lender usually comes up with other things to ask for from borrower

Step 4- Final Underwriting, Closing, and Funding

- Lender sends complete file to underwriting, and they may find issues or require more things at that point

- Final coordination between title company and lender on loan docs and scheduling

- Closing and Funding

Multifamily DSCR Loan vs. Multifamily Bank Term Loan Requirements

Most of the requirements for Multifamily DSCR loans and Multifamily Bank Term Loans are outlined in the graphic above. If you are getting your stuff together to apply for a Multifamily DSCR loan or Multifamily Bank Term Loan, please be ready to meet the following requirements:

- Loan Application

- Schedule of Real Estate Owned

- LLC documents including Operating Agreement (if applicable)

- Title Policy meeting lender requirements

- Insurance Policy meeting lender requirements

- Leases

- Last 12 months and projected Operating Expenses

- Purchase contract (if purchase)

- HUD1 from purchase (if purchased recently)

- Summary of work completed at the property (if applicable)

- Completed appraisal (ordered by lender, paid for by borrower)

- Environmental study (if applicable)

- No income verification required for Multifamily DSCR Loan

- 2 years business and personal income, and asset verification, required for Multifamily Bank Term Loan

Multifamily Private Bridge vs. Multifamily Bank Bridge Loan

Bridge financing is available for value add multifamily projects. Private lenders do not require full income and asset verification, and some private lenders aggressive on leverage for multifamilly. Banks lend for multifamily value add bridge and construction to perm. Banks and institutional lenders would be a natural choice for more established borrowers, or for larger loans.

Private multifamily bridge lenders will lend up to 75% of purchase price and 100% of rehab budget, and lenders have investor experience requirements. The plan would be to pay back the loan by selling the property or refinancing with a multifamily DSCR loan, or any multifamily term loan.

Bank loans for multifamily value add bridge loans are often structured as construction to perm loans. The banks have less appetite for construction loans, but if they want the term loan, that gives them more reason to fund a multifamily bridge loan.

Underwriting Multifamily Loans

Underwriting multifamily loans is an exercise in calculating the income and expenses for a multifamily property against the loan payments. We can quickly size loans against DSCR parameters to arrive at max loan amounts for multifamily DSCR loans and multifamily bank term loans. We can apply the same exercise to multifamily bridge deals to see if they will meet as complete DSCR requirements for lenders. The loan amounts also max at a percentage of appraised value for refinances, and both percentage of appraised value and percentage of purchase price for purchases. All loans are subject to credit approval and have at least some borrower level requirements.

Nonbank Clearing Advantages

- Compare bank and private lender options

- Internal underwriting to quickly size multifamily loans

- Terms vary more for multifamily, so there is more value in having competitive bids